About the Sellers Claim for Refund

Which tax types can file online for a refund?

- Aviation Fuel Tax

- Cigarette License

- Cigarette Tax

- Consumer Use Tax

- County Lodging Tax

- International Fuel Tax Agreement (IFTA)

- Liquor Tax

- Local Marketing Tax

- Nicotine Products License

- Nicotine Products Tax

- Prepaid Wireless Charge

- Public Utility Administration Fee

- Retail Marijuana Excise Tax

- Retail Marijuana Sales Tax

- Sales Tax

- Tobacco Products License

- Tobacco Products Tax

- Wage Withholding Tax

- Winery Shipper Excise Tax

Important Note:Different tax types such as sales tax vs. consumer use tax must be submitted separately.

Why file online?

- Save postage and time mailing

- Reduce errors and incomplete submissions

- Sales Tax filers can include multiple jurisdictions (state, RTD/CD, city and county) on one submission

- Receive confirmation that your claim has been received within 24 hours of a successful transmission.

Who is eligible to file online?

- Established Colorado Taxpayers:

- Taxpayers with Revenue Online Access.

- Who have previously filed returns

- Have a Colorado Account Number (CAN)

- Are registered with a Federal Employment Identification Number (FEIN) or Social Security (SSN)

- Taxpayers with supporting documentation to attach to the claim.

How to File a Claim for Refund Using Revenue Online

Download Step-by-Step Instructions

Step 1: Review the instructions and documentation requirements based on tax type prior to filing your request. These are available on the Claim for Refund Form (DR 0137).

Step 2: Visit Colorado.gov/RevenueOnline and log into your account.

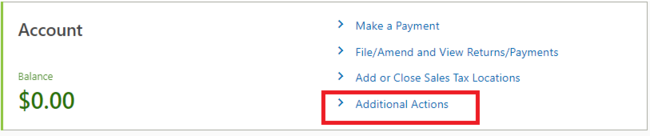

Step 3: Click “Additional Actions.”

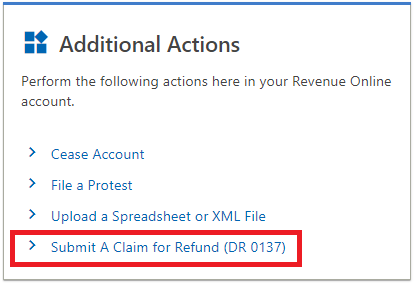

Step 4: Then click “Submit A Claim for Refund (DR 0137)” and follow the prompts.

NOTE: Once you submit your claim for refund online, do not mail a copy to the Department.

How to Submit Missing Information or Documentation

If following your original filing you have identified missing documents or information, please provide it as soon as possible.

Step 1:Log into your Revenue Online Account.

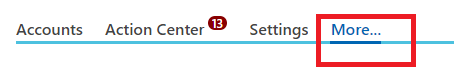

Step 2:Click“More...”

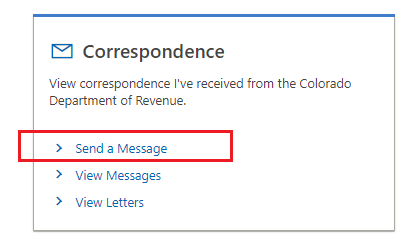

Step 3: Under Correspondence, click“Send a Message” and reference the confirmation number received.

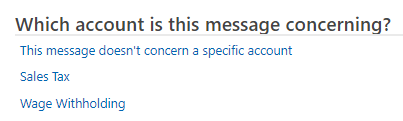

Step 4:Select the tax type related to the claim.

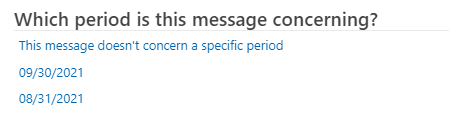

Step 5: Select a period related to the claim.

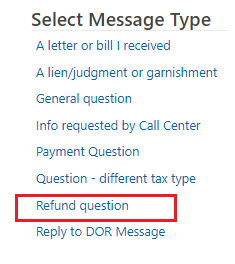

Step 6: Choose “Refund question.”

Step 7: Enter the words “Additional Information” along with your confirmation in the Subject line.

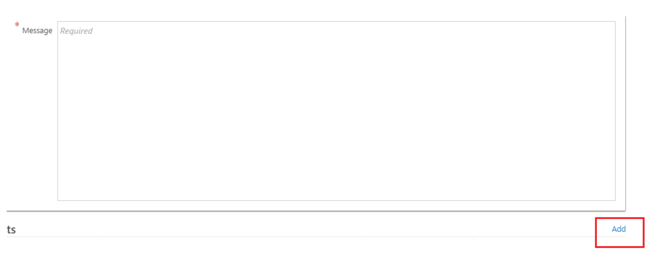

Step 8: Provide additional information in the Message field and attach documentation by clicking “Add.” The “Add” link is located at the bottom right hand side.